The Secret Of Info About How To Lower Your Agi

/AGI-FINAL-6a232c512a9d4606a0c8a29fa57dbb59.png)

Sell loser securities held in taxable brokerage firm accounts.

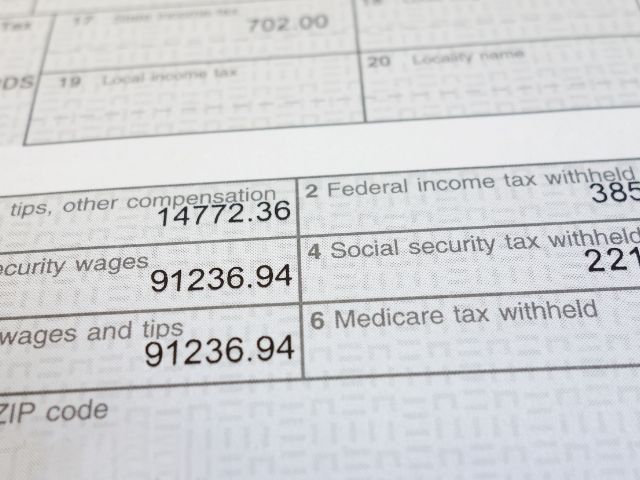

How to lower your agi. Reduce your agi income & taxable income savings contribute to a health savings account. Agi equals all taxable income items minus selected deductions for such items as deductible ira and. If you own an ira and wish to lower your agi, you can use the qcd rule to efficiently disperse money to a charity of your choice.

That means it's often in your best interest to lower your agi as much as possible. Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to enroll in. And here are a few strategies that will help reduce your agi:

This strategy is superior to taking receipt. It’s not too late to reduce your agi for the current tax year. Contribute to ira / 401k plan:.

Deduct alimony as well as educator, moving and other expenses , which can lower your adjusted gross income. Sell assets to capitalize on the capital loss. Contributing money to a retirement plan at work like a 401 (k) plan can reduce a.

How do you reduce your taxable income / agi / magi? See if you qualify for any other deductions on page 1 of your form 1040 that aren't added back into the magi. Here are 5 ways to reduce your taxable income 1.

Reduce agi with adjustments to income when you file your tax return, you can reduce your total taxable income with adjustments to income. See the first page of form 1040 for more ideas. Make the most of other deductions that reduce your agi.