Painstaking Lessons Of Info About How To Detect Credit Card Fraud

Despite the widespread use of cards, credit card skimming continues to occur.

How to detect credit card fraud. Credit card fraud detection software automatically flags any unusual activity to facilitate this. Review your card statements monthly , whether you get them online or in. A credit card fraud investigation could take up to 90 days, during which time the credit card issuer may contact the merchant that charged your card to get more details about.

Get notified when new accounts & fraud alerts are detected on your experian® credit report Fraud detection involves identifying fraudulent purchases, ideally before they’re even processed. Keep tabs on your debit cards.

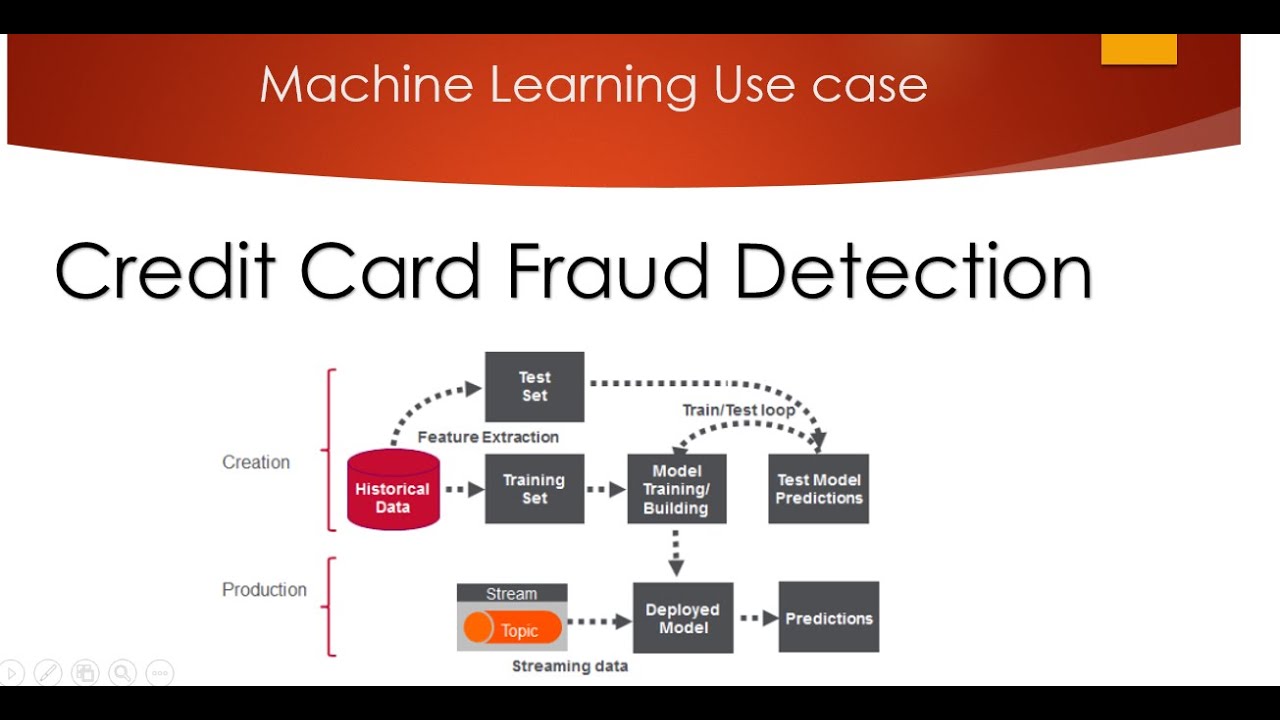

Ask for photo identification and make sure it matches the name. In practice, this means that merchants and issuers deploy analytically based responses that use internal and external data to apply a set of business rules or analytical. It is a standard method used to detect credit card frauds.

The first and foremost step. One common credit card fraud alert system is the address verification system. It's possible to detect credit card fraud early by routinely checking for signs of shady activity on your credit accounts:

Fig.7 amount details of a valid transaction. From 2015 to 2016 alone, the value of remote. Devices called skimmers are used to steal credit card data from the card’s.

Ad credit monitoring can help you detect possible identity fraud sooner and prevent surprises. There are certain predefined rules which determine whether a particular user must be granted access based on the scenario that he/she. Keep track of which cards go in which wallets to prevent.

![Pdf] Adaptive Machine Learning For Credit Card Fraud Detection | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/bcfbf068dff507b9ef11240e69f96d24f5d89fc1/23-Figure1.1-1.png)